Giving hope

How a venture philanthropy-backed social micro-finance programme is creating brighter futures for widows, female breadwinners, and their families

How a venture philanthropy-backed social micro-finance programme is creating brighter futures for widows, female breadwinners, and their families

The Amal Project is an economic empowerment programme providing low-cost loans to vulnerable widows and female breadwinners across Egypt.

A collaborative initiative by Alfanar, the oldest venture philanthropy organisation in the Arab region, and the Global Fund for Widows, Amal is delivered by the Egyptian nonprofit microfinance organisation, Future Eve Foundation, which in turn identifies and trains other local nonprofit microfinance organisations to enable the programme to grow.

Amal’s vocational and financial literacy training, affordable micro-loans and widows savings and loan associations help female breadwinners start businesses and support their families. They offer a pathway to financial independence for vulnerable widows, who are often held hostage to gender and culture norms, which can prevent them from accessing finance and trap them in poverty.

Since its launch in 2012, Amal has enabled more than 23,000 female breadwinners across 108 villages in Egypt to set up micro-enterprises and to achieve financial and economic independence, breaking inter-generational poverty cycles and delivering new hope to families across the region.

When Eugine Awadalla from Alexandria, Egypt, was widowed in her mid-30s, she was plunged into poverty after her brothers-in-law denied her inheritance rights.

Forced to sell her possessions to clear the healthcare debts of her late husband, Awadalla took all but one of her four young children out of school, and struggled to make ends meet, a far cry from the married upper middle-class life she had always known.

Some years later when Awadalla passed away, thousands of miles away in New York City, Heather Ibrahim revisited her grandmother’s life story and felt what she describes as a “moment of obligation”.

In 2009, Ibrahim, who had just stepped back from a career on Wall Street to have a family, decided to set up a nonprofit – the Global Fund for Widows (GFW) – to encourage economic empowerment for widows and to help advocate for their rights.

Despite wanting to start working in Egypt in 2011, where 57 percent of households are headed by women and widows, Ibrahim struggled to find an entry point given the political flux created by the Arab Spring and overthrow of former President Hosni Mubarak. “It was very difficult for us to support work there as an international NGO at the time,” she recalls.

Eventually, through a mutual contact, Ibrahim was passed the number of Myrna Atalla, the executive director of Alfanar.

Alfanar, the Arab region’s first venture philanthropy organisation, had begun working in Egypt in 2005 and had been building up its track record and approach to supporting the growth of social enterprises working to improve children’s education and women’s economic empowerment.

While sitting on a packed bus in New York City, Ibrahim pulled out her mobile phone and made a call. Remembering the day vividly, UK-based Atalla explains how the discussion with Ibrahim was pivotal to opening her eyes to the vulnerabilities faced by widows.

After speaking to Ibrahim, she says she was compelled to find a way for Alfanar to work with GFW to make a meaningful difference, and Amal – which means “hope” in Arabic – was born.

Around one in 10 of the world’s 250 million widows live in poverty due to historic and systemic oppression, disinheritance, gender-discrimination, cultural stigmas, and violent traditional practices. Unsupported, unprotected, and vulnerable, widows in the developing world often find themselves socially and financially excluded. Struggling to make ends meet and support their families, they are forced to pull children – especially girls –out of school, entrenching generational poverty and fuelling other harmful coping mechanisms such as early marriage and sexual exploitation.

Read more about rights violations against widows here.

Guided by Alfanar’s venture philanthropy approach, the search began for ambitious social enterprises committed to economically empowering vulnerable women and female breadwinners while also securing their organisation’s long-term financial sustainability through self-generated revenue streams.

Alfanar’s Egypt country director, Shenouda Bissada, set about running a competitive selection process, assessing multiple applications, and completing due diligence. After securing approval from the boards of both Alfanar and GFW, a pilot venture philanthropy grant to the Egyptian NGO Future Eve Foundation (FEF) began.

Headquartered in Minya in Upper Egypt, south of the capital Cairo, FEF was established in 2001 to help women by promoting community development. Its programmes range from economic empowerment, including microfinance, and supporting legal rights to raising awareness about reproductive health issues and working to prevent female genital mutilation.

In 2012, with a grant of US$25,000 from the Global Fund for Widows, Alfanar coupled target-conditioned funding with its high-engagement management support and oversight to FEF.

After one year, the pilot had provided 250 widows and female breadwinners in three under-served villages in the governorate of Minya with vocational and financial literacy training, and access to affordable micro-credit to establish their own microenterprises.

Twelve years later, what began as a small pilot has evolved into a thriving economic empowerment initiative that has improved the lives of over 23,000 widows across 108 villages in five governorates across Egypt, namely Minya, Beni Sueif, Alexandria, Luxor and Sohag.

As it grows across governorates, FEF identifies other community-based microfinance nonprofits concerned with women’s economic empowerment and trains them on the Amal Project values and approach.

To date, The Amal Project has trained and funded four partners to grow Amal’s impact and reach and is currently working with five new partners to scale it further.

Over the years, the Amal Project has attracted additional funding partners including UKAID, Egyptian real estate giant SODIC, The Whole Planet Foundation, HSBC as well as numerous generous Alfanar individual donors. This collective support over the years has enabled the programme to expand and evolve gradually.

In 2024, with funding support from The Ford Foundation, Alfanar will work with GFW and FEF to document the Amal social franchise standard operating procedures in preparation for further expansion across Egypt and values-based, systematic replication in Lebanon and Palestine.

“When we started, we were not thinking beyond one year,” says Sherif Labib, FEF founder and director. “But when we saw the programme’s success, this really sparked interest in finding ways to expand and enhance the model and make it sustainable.”

“It’s not enough for me to teach the widows how to fish. I want the widows to own the lake."

Heather Ibrahim, GFW founder and director

Female-headed households are often forced to remove children from school due to limited income. Amal is giving them a way to support themselves. Photo: Alfanar

The Amal Project serves disadvantaged and vulnerable widows as well as ‘functional widows’, women whose husbands are terminally ill and unable to work, women who are divorced or abandoned, or women who are married to seasonal workers who lack a steady income. In other words, women upon whom the burden of a family’s financial needs falls.

1. Capacity-building & skills training

The Amal Project helps widows build up their vocational and financial literacy skills to help them start their own businesses. Vocational training ranges from poultry and livestock rearing, hairdressing, food production and more. Financial literacy, meanwhile it taught in a simple and accessible way to deliver to even illiterate widows a range of topics critical to successful business management, including wholesale and inventory management, marketing, and customer service.

2. Social microfinance

Once the women have completed training, they are eligible to apply for an Amal microloan to support their business plan. Amal offers widows a range of different loans at low interest rates depending on the microenterprise they want to launch. Due to Egypt’s steadily rising inflation rates, entry level loans today begin at 10,000 EGP (US$214 – at time of writing) and go up to 40,000 EGP ($850), repayable at 14 percent over 10-18 months. It is worth noting that Egypt’s commercial microlenders charge clients interest rates of 24-40 percent for microloans.

The widow clients of the Amal Project have a remarkable 99 percent credit repayment rate and 97 percent confirm a desire to further grow their business and to grow the size of their microloan. On average, Amal’s widows achieve a 38 percent increase to their take-home income. “These results underscore the demand for and transformative potential of Amal,” notes Labib from FEF.

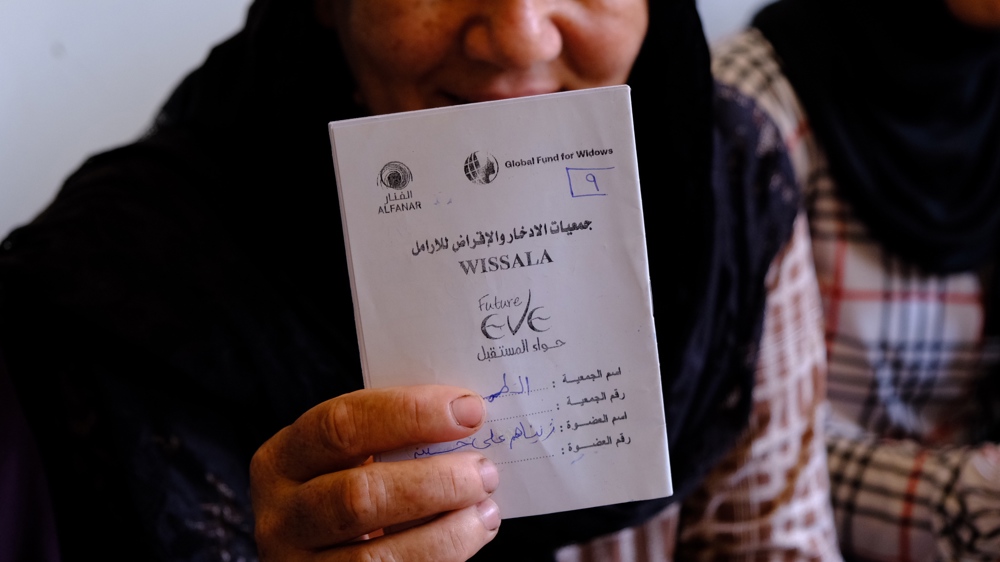

Widows’ savings and loans associations (WISALAs) are a way for unbanked widows and female breadwinners to build their confidence in financial instruments. Photo: Alfanar

3. Widows’ savings and loans associations (WISALAs)

Widows and female breadwinners who are unbanked or have no prior financial experience are encouraged to build this confidence by joining what has been coined and developed by GFW – a WISALA – rather than taking on an individual microloan. For this, groups of 15 to 20 women meet together on a bi-monthly basis to systematically set aside their personal savings. They become co-owners, owning shares in what is essentially a widow bank. Their pooled savings are then doubled by Amal, enabling them to revolve more meaningfully.

WISALA members approve loans to one another to establish or grow their business or if in need of additional support. WISALA group members set WISALA loan interest rates and hold one another accountable through the social collateral that builds up through regular meetings.

The group nature of WISALAs gives participating widows the experience of making an initial investment and what it can render as they begin to see, with each loan the group approves, the impact it is having to other widows.

One widow participating in a WISALA group tells Circle: “We like seeing our money grow and putting our money in a safe place. The idea that we put in small amounts, and when it is our turn to take the money, we can take a big amount, and we can do a lot with that.”

Another explained how the project had helped the community bond. “The act of saving the money, it’s giving me a purpose,” she says. “I feel a sense of agency and ownership and power, that I can do things. It has also created a stronger sense of community and belonging between us as women, we see each other every week and save together and help each other.”

Ibrahim adds: “The Amal Project as a whole is guided by The Golden Rule – she who has the gold makes the rules. WISALAs, in particular, help widows understand this principle and take full ownership of their path to economic empowerment.

4. Social contracts

The final aspect of The Amal Project is about awareness-raising. Amal loan officers facilitate information sessions provided by Egypt’s Ministry of Insurance and Social Affairs focusing on widow rights and entitlements, including pensions, health insurance, and educational assistance for their children. The Amal Project helps its clients to secure their national ID cards so they can be eligible for other forms of social protection and support.

The Amal Project is giving widows new skills and allowing them to earn money for their families. Photo: Alfanar

Since launching in 2012, the Amal project grown remarkably. Starting with just 250 widows in three villages in Minya, it has expanded its reach to empower over 23,000 women in 108 villages across five governorates in Egypt (Minya, Beni Sueif, Alexandria, Luxor, and Sohag).

This expansion has been made possible by selecting and training up suitable local microfinance institutions in the target areas of growth. To date, FEF has trained and sub-granted the Alexandria CBR Association, the Key of Life Association (Luxor), the Women Association for Health Improvement (Sohag) and the Ana Masry Association (Qena).

Sixteen percent of Amal’s 23,000 widow clients have taken multiple loans. On average, widows increase their take-home income by 38 percent, making a strong case for the wider impact of well-managed microcredit programmes.

Amal widows, meanwhile, have gained expertise in a variety of industries, from animal rearing and management to food production, retail, and beauty services, and benefitted from essential soft skills training in leadership, entrepreneurship, and effective communication.

Thanks to Amal, widows have been able to pay off debts, send their children to school, establish savings, and hire others – including fellow widows and even men – to assist in their businesses.

The initiative has also facilitated widows' access to government entitlements, with some 600 widows to date successfully registering for pensions and other essential support services on the back of information sessions made possible by Amal.

Women who have historically been trapped in unbreakable poverty cycles through no fault of their own are now being empowered to support their families and rewrite the narrative for their children and grandchildren.

There has also been a profound impact on widows' self-esteem and social standing. According to a survey conducted in 2024, 94 percent of Amal widows report feeling economically empowered, 70 percent have improved their social status within their communities, and 93 percent report gaining confidence, especially it relates to claiming their legal rights.

Amal’s work has not gone unnoticed in Egypt’s corridors of power. Since the project began, two new laws have been passed offering greater protection to widowed women. In 2017, Maya Morsi, the president of the National Women’s Council of Egypt, enshrined a new law to protect widows’ rights to inheritance and to criminalise acts of disinheritance. One year later, Dr Morsi, now a Minister of State, issued 50,000 widows and female heads of household with government pensions.

“We have a great friend in Minister of State, Maya Morsi,” says Ibrahim. “She has changed two laws in Egypt to support us in the work that we are doing, because she understands the value of addressing the situation of widows.”

Zeinab, pictured above with her two daughters, Malak and Zarah, was widowed when she was just 24 years old. She initially moved to her late husband’s family home, but later relocated to her own father’s house. Thanks to Amal, she has now opened a small shop selling laundry items and other household goods near her home in Minya, Upper Egypt. When she began the business, Zeinab, now 33, struggled to access affordable credit, but Amal has made this possible. "I used to get money from the bank, which was so expensive to pay back. After hearing about Amal, I qualified and took two loans, one of EGP 10,000 (US$212) and a second for EGP 15,000 ($320)," she explains. "Their size and repayment terms gave me flexibility and I could also save," she added. "As well as growing my business, I am also saving money to upgrade my home. The loans are good because I can pay them back in instalments and via a digital payment gateway, so it is easier for me to manage."

Alfanar Egypt country director, Shenouda Bissada (left), and Future Eve Foundation founder and director, Sherif Labib (right) with a widow with a poultry micro-enterprise. Photo: Alfanar

Alfanar has raised and administered 10 grants to FEF since 2012 worth GBP £1,197,705. This funding has been used by FEF to run the entire Amal project, from providing vocational and financial literacy training, microloans and Widows’ Savings and Loans’ Associations (WISALAs).

Beyond funding, Alfanar, with full commitment from The Global Fund for Widows, provides high-engagement management support as part of its venture philanthropy support package. This comes in the form of weekly accountability check-ins, regular trainings and opportunities for social enterprise upskilling, business planning and reforecasting and audits.

Alfanar adds GBP £0.63 in impact and business management support to every £1 disbursed in grants or zero-interest loans. This enables FEF and all the social enterprises supported by Alfanar long-term to more than triple both impact on disadvantaged communities and their self-generated revenue.

“On average, our social enterprises recovered 66 percent of costs in 2023 through their own self-generated revenue,” Atalla explains. “Amal’s near break-even cost recovery rate is not an anomaly – with 52 percent of Alfanar’s portfolio growing impact in line with revenues or at break-even.”

She adds: “This unique focus on helping the social enterprises we back to achieve self-sufficiency is signature to Alfanar and a promise we give all our funders, including The Global Fund for Widows. In this way, we ensure that we and our partners will have long-lasting impact for widows and all the vulnerable groups we are supporting.”

Following a recent financial audit administered by Alfanar, FEF strengthened its financial accounting and management system, shifting to Xero, digitised its core training modules to mainstream and scale its training to partners, moved the cashless payments to its clients, and established coordination platforms to bring the growing number of Amal partners together.

Through Alfanar Impact Management (AIM), Alfanar has also helped FEF to develop, use and benefit from a bespoke digital app that helps them monitor progress on key impact and financial metrics. The access to business intelligence technology Alfanar gives its social enterprises allows them – sometimes for the first time – to properly visualise their impact and to begin making evidence-based management decisions. AIM reduces the burden of reporting, while allowing Alfanar to better target its mentorship and management support.

Widows at a meeting discussing their WISALAs. Photo: Alfanar

Refined over 12 years, the Amal Project has a proven approach. With funding support from The Ford Foundation, Alfanar is working with GFW and FEF to document and codify the programme’s standard operating procedures into a ‘social franchise manual’ that will be completed by the third quarter of 2024.

This tool will help expedite the programme’s ramp-up across Egypt and beyond by simplifying the identification and onboarding of more community-based microfinance institutions to implement the Amal programme. The team is currently targeting other countries where Alfanar has existing venture philanthropy operations, namely Lebanon and Palestine, to enable efficient growth and strong value for money.

The success of the Amal Project is a testament to what can be achieved through passion, trust, and collaboration. “GFW has not only funded the growth of Amal over the years but has exhibited strong faith and belief in both Alfanar and FEF,” Shenouda Bissada, Alfanar’s Egypt director, tells Circle.

“At points, we didn’t know how it would work, nor did GFW or FEF I don’t think, but when you really believe in something that is making a tangible difference in people’s lives, opportunities emerge.” Ibrahim says Amal owes a lot of its success to its partnerships.

"GFW wanted to make sure that we were with partners that are professional, know what they are doing, understand the importance of data systems, work with integrity, and are truly dedicated to making an impact. And that is what we have.”

Alfanar, GFW, and the Future Eve Foundation have met weekly to discuss Amal for over 10 years. “Since 2011, we have met literally every week to review results, troubleshoot, course-correct and celebrate,” says Atalla. “This is real partnership. The success was not the result of any one entity. Amal has thrived on co-creation, emergent strategising and a willingness to adapt based on data and evolving circumstances,” she adds.

The plan to grow Amal into a social franchise that expands across Egypt and to other Arab countries is part of a shared desire to prove that this low-cost, bottom-up model can uplift an additional 20,000 widows and female breadwinners in half the time, if not faster. If successful, this would represent Alfanar’s first scale-up via social franchise.

The organisation hopes that it will be able to leverage lessons learned to other social enterprises in its portfolio contemplating similar growth pathways. “Amal is not just a ‘feel good project’ that ends when the funding dries up,” explains Atalla.

“Through the combination of funding, technical assistance and non-financial support and impact management, we and our partners have established a self-sustaining change agent that will continue impacting more and more widows, even after we exit. And by extension, more and more children will have opportunities they might not have had, and they will grow up to change the face of our region.”

Atalla hopes Amal can send a message to philanthropists and corporate donors in and beyond the Arab region about the benefits of patient, collaborative and multi-dimensional social investment.

"Amal has thrived on co-creation, emergent strategising and a willingness to adapt based on data and evolving circumstances."

Myrna Atalla, executive director, Alfanar

Widows’ savings and loans associations (WISALAs) have given unbanked widows and female breadwinners new opportunities to become financially self-sufficient. Photo: Alfanar

Alfanar, founded in 2004, is the Arab region’s first venture philanthropy organisation, providing tailored funding and management support to promising social enterprises with the aim of scaling their impact and financial sustainability. Combining the principles of private sector investment with philanthropic giving, Alfanar provides donors a transparent and credible platform through which to drive lasting change. To date, Alfanar has granted £8 Million to 98 social enterprises across Egypt, Lebanon, Jordan, and Palestine, which in turn, have self-generated £18 Million through the sale of goods and services. UK-registered Alfanar has positively influenced the lives of nearly 400,000 vulnerable women and children. Beyond The Amal Project, notable success stories include FabricAid, Bridge. Outsource. Transform (B.O.T), Tabshoura and Educate Me. Read more

The Global Fund for Widows (GFW) is a US-based nonprofit launched in 2009 by former Wall Street banker Heather Ibrahim. In additional to supporting the growth of Amal and establishing the concept and practice of WISALAs, GFW supports widows in Egypt, Kenya, Tanzania, India, Cameroon, and Nigeria. Ibrahim worked with over 100 Member States in the United Nations to shepherd the world’s first General Assembly resolution protecting the rights of widows to a unanimous adoption. For her indefatigable efforts, Ibrahim was nominated for the Nobel Peace Prize in 2021. Read more

Future Eve Foundation (FEF) is one of the leading NGOs in Minya, Egypt. Founded in 2001, it is dedicated to women’s empowerment. Beyond The Amal Project, it also raises women's awareness on various subjects such as education, legal rights and reproductive health, as well as combating female genital mutilation. Read more

Circle travelled to Minya to meet Amal participants in October 2023 as a guest of Alfanar. This case study was researched by Alya Hegazy with editing from Alexis James and Louise Redvers.

It's a good idea to use a strong password that you're not using elsewhere.

Remember password? Login here

Sign in to access all of our content and resources.

Not subscribed? Register here. Forgotten your password? Reset here